Get £50,000 – £500,000 in Business Funding, Compare Multiple Lenders in Minutes

Fast approvals. FCA-authorised lenders. No obligation quotes.

Why Choose Us

Why SMEs Trust Freddie with Their Funding

Explore a range of smart solutions designed to make business finance simple and stress-free. With Freddie, you skip the paperwork and the long waits — and go straight to the funding that fits your business best

How It Works

How Funding Freddie Works

Fill in one simple form.

Get matched instantly with FCA-approved lenders.

Compare offers & choose the best option.

Testimonials

Real Businesses, Real Funding Success

Why Trust Us

Safe, Secure & FCA-Compliant

We only work with FCA-authorised lenders.

Your data is encrypted & never resold without consent.

No obligation to accept an offer.

FAQ's

Frequently Asked Questions

We know applying for business funding can feel overwhelming. That’s why Freddie makes it simple, clear, and transparent.

Will checking my eligibility affect my credit score?

No. We only use a soft search when you apply, which means your credit score is not affected.

How quickly can I get funding?

Many SMEs receive approval within 24 hours, with funds available in as little as 48–72 hours depending on the lender.

Do I have to accept an offer?

Not at all. There’s no obligation — you can compare offers from multiple lenders and choose the one that best suits your business.

What type of businesses can apply?

We work with a wide range of SMEs, from retail shops and restaurants to logistics companies, tech startups, and professional services. If your business is registered and trading, you may qualify.

What loan amounts are available?

You can apply for funding between £50,000 and £500,000, depending on your business profile and needs.

What documents do I need to apply?

Most lenders require recent bank statements, proof of trading history, and basic business details. The process is designed to be as simple as possible.

Are you FCA regulated?

Funding Freddie only works with FCA-authorised lenders, so you can be confident your application is safe, secure, and compliant.

Join hundreds of UK businesses already securing funding through trusted FCA-authorised lenders.

Ready to See Your Funding Options?

It only takes 60 seconds to check your eligibility — with no impact on your credit score.

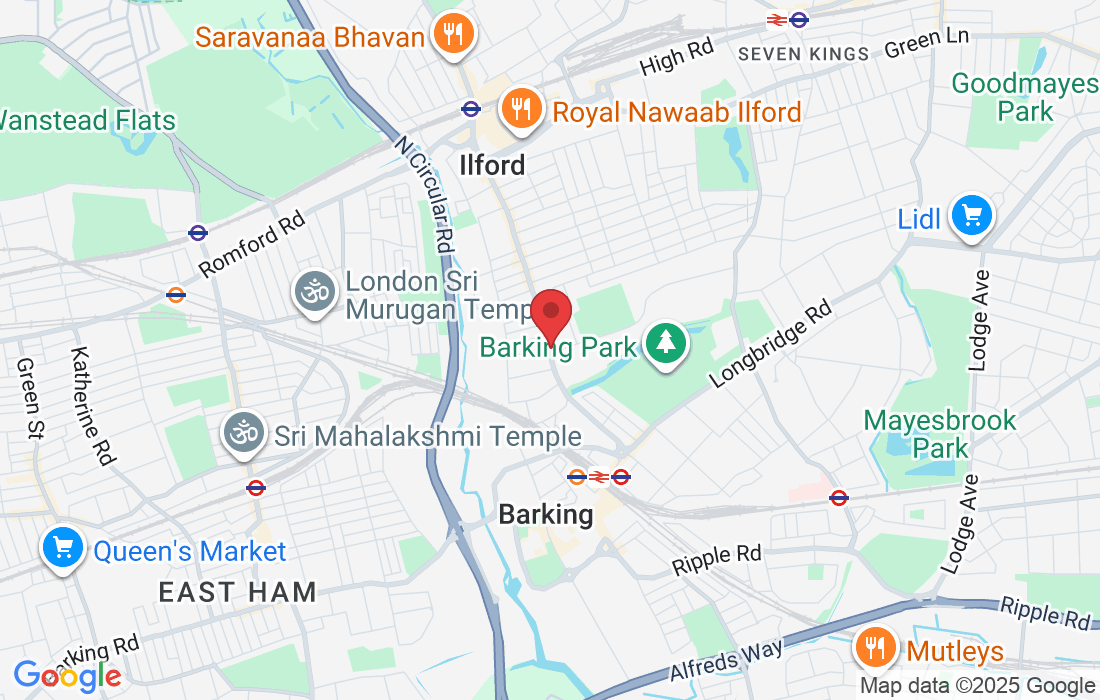

Address: Ilford Lane, Ilford, England, IG1 2SN

Email: [email protected]

Phone: 0741 410 7585

Opening Hours: Available 24/7 to answer your questions and guide you.

You can also complete our online eligibility form anytime, 24/7

Funding Freddie is a trading name of Digital Success Blueprint Ltd. Registered in England and Wales. Registered address: 411 Ilford Lane, Ilford, England, IG1 2SN.

Funding Freddie is not a lender. We act as an introducer, connecting SMEs with a panel of carefully selected FCA-authorised lenders. All loan agreements are made directly between the applicant and the lender.