Trusted Commercial Finance Broker in London

Commercial Finance Broker in London — Fast, Flexible SME Funding

Running a business in London isn’t easy. From rising costs to fierce competition, cash flow challenges can stop even the strongest SME from reaching its potential. That’s where Funding Freddie steps in.

We act as your commercial finance broker in London, connecting business owners directly with FCA-approved lenders who understand your industry. Whether you’re looking for £50k to keep cash flowing, £250k to expand, or £500k to invest in equipment, Freddie makes funding simple, fast, and transparent.

The Smarter Way to Secure Business Funding

Why Work With a Commercial Finance Broker in London?

Banks make business lending complicated:

Endless paperwork

Rigid approval criteria

Weeks or months waiting for a decision

By working with a London-based finance broker like Funding Freddie, you:

Save time — one form, multiple lenders compete for your business

Get better terms — brokers negotiate on your behalf

Access more choice — from working capital to property loans

Gain speed — many decisions in 24–48 hours

Instead of chasing banks, you focus on running your business — while Freddie connects you with the funding you need.

Helping London SMEs Access the Right Finance, Fast

Funding Freddie — Your Local Partner for SME Finance

At Funding Freddie, we specialise in helping London SMEs unlock growth through the right type of finance.

Our process is simple:

One simple form → takes under 60 seconds.

Smart matching → Freddie connects you with multiple FCA-approved lenders.

Your choice → review offers, compare rates, and choose the one that works best.

No obligation.

No pressure.

No hidden fees.

Just clear, flexible funding — the way it should be.

Types of Funding We Offer

From working capital to expansion loans, we connect you with multiple lenders to find the right solution for your business at every stage of growth.

Working Capital Loans

Running a business in London often means juggling cash flow — especially with rising costs and seasonal fluctuations.

A working capital loan gives SMEs quick access to £50k–£500k to cover payroll, supplier invoices, or temporary dips in revenue.

Example: A Shoreditch café used a £75k working capital loan to stay stocked during peak season and cover short-term costs while waiting on supplier payments.

👉Learn more about Working Capital Loans

Expansion Loans

Growth takes investment, and an expansion loan helps SMEs scale faster.

Whether you’re opening a new location in Canary Wharf, adding staff, or upgrading your space, these loans provide flexible repayment options matched to your turnover.

Example: A Croydon logistics firm used a £250k expansion loan to open a new depot, doubling capacity and creating 12 local jobs.

👉Learn more about Expansion Loans

Equipment Financing

Outdated equipment can slow operations and reduce efficiency.

With equipment financing, London businesses can spread the cost of upgrading machinery, vehicles, or technology without straining cash flow.

Example: A Southwark restaurant secured £100k in equipment finance to upgrade its kitchen and increase capacity by 35%.

👉Learn more about Equipment Financing

Invoice Factoring UK

Unpaid invoices shouldn’t hold your business back.

Invoice factoring lets you unlock cash tied up in receivables, giving you immediate liquidity to reinvest in growth.

Example: A Hackney creative agency factored £80k in invoices to fund a new project and expand their client base.

👉 Learn more about Invoice Factoring →

Commercial Property Loans UK

If your next step involves buying or refinancing business premises, commercial property loans make it possible.

Funding Freddie connects you with FCA-authorised lenders offering £50k–£500k+ for purchases or refinancing.

Example: A Stratford retailer used a £200k property loan to purchase a second shop, growing monthly revenue by 25%.

👉 Learn more about Commercial Property Loans →

Proven Results for London’s Small Businesses

Real Business Success Stories in London

Shoreditch Café → £50k working capital loan → refurb & relaunch → +40% revenue.

Canary Wharf Logistics Firm → £250k expansion → new hub & 12 jobs created.

Croydon Retailer → £75k invoice factoring → stayed stocked at Christmas → +30% sales.

Stratford Restaurant → £100k kitchen upgrade → +35% efficiency.

These aren’t just numbers — they’re examples of how London SMEs grow faster with Funding Freddie.

How It Works

When you work with Funding Freddie, you get more than just loan options — you get peace of mind.

Tell us about your business

Industry, turnover, loan amount

Freddie matches you instantly

Multiple FCA lenders compete for your application

Choose your offer

Compare terms & rates, no obligation

Get funded

Many approvals in 24–48 hours

Freddie’s role is to give SMEs confidence — because when small businesses grow, communities thrive. That’s why we’re trusted for secure business finance across the UK.

Built for London Businesses

Our Local Advantage — London’s SMEs Deserve a Better Option

London’s economy thrives on small and mid-sized businesses, but access to funding hasn’t kept pace with demand. Banks remain slow and selective, leaving many growth-ready companies without support.

Funding Freddie bridges that gap by working directly with FCA-authorised lenders who understand London’s business landscape, from Shoreditch startups to Croydon logistics firms. We make funding fast, transparent, and accessible — without the red tape.

Why London SMEs Choose Funding Freddie Over Banks

Banks

When you work with Funding Freddie, you get more than just loan options — you get peace of mind.

Banks

Slow approvals

Strict criteria

Hidden fees

Freddie

Fast decisions (as little as 24h)

Tailored to your business profile

FCA-approved lenders only

Transparent process (no hidden costs)

FAQ's

Commercial Finance Broker London — FAQs

We know applying for business funding can feel overwhelming. That’s why Freddie makes it simple, clear, and transparent.

What industries do you support in London?

👉 We help retailers, restaurants, logistics firms, creative agencies, professional services, and more.

Can startups apply for a loan?

👉 Yes — lenders consider turnover and growth potential, not just trading history. Some products, like equipment finance, are available even for newer businesses.

Do you charge fees for your service?

👉 No — Funding Freddie is free for SMEs. We are paid by lenders if your loan is approved.

Can I apply if I already have a business loan?

👉 Yes — many lenders offer refinancing or secondary funding if your business can support it.

What’s the minimum and maximum amount I can borrow in London?

👉 Funding Freddie helps SMEs access between £50k and £500k, depending on your business profile and funding purpose.

How fast can I get approved for business funding?

👉 Many London SMEs receive approval within 24 hours, with funds available in 2–3 working days.

Do I need a perfect credit score to qualify?

👉 No. We work with multiple lenders who assess your business holistically, not just your credit score.

Are your lenders FCA-authorised?

👉 Yes. Every lender we partner with is FCA-authorised, ensuring all loans meet strict UK financial regulations.

Can I apply if I’ve been declined by a bank before?

👉 Absolutely. Many of our lenders specialise in helping businesses that traditional banks overlook.

Can I use a commercial finance broker for multiple funding types?

👉 Yes. Whether you need working capital, expansion finance, or equipment loans, Funding Freddie can match you to several lenders offering different products.

Join hundreds of UK businesses already securing funding through trusted FCA-authorised lenders.

Explore More Business Funding Insights

Related Guides:

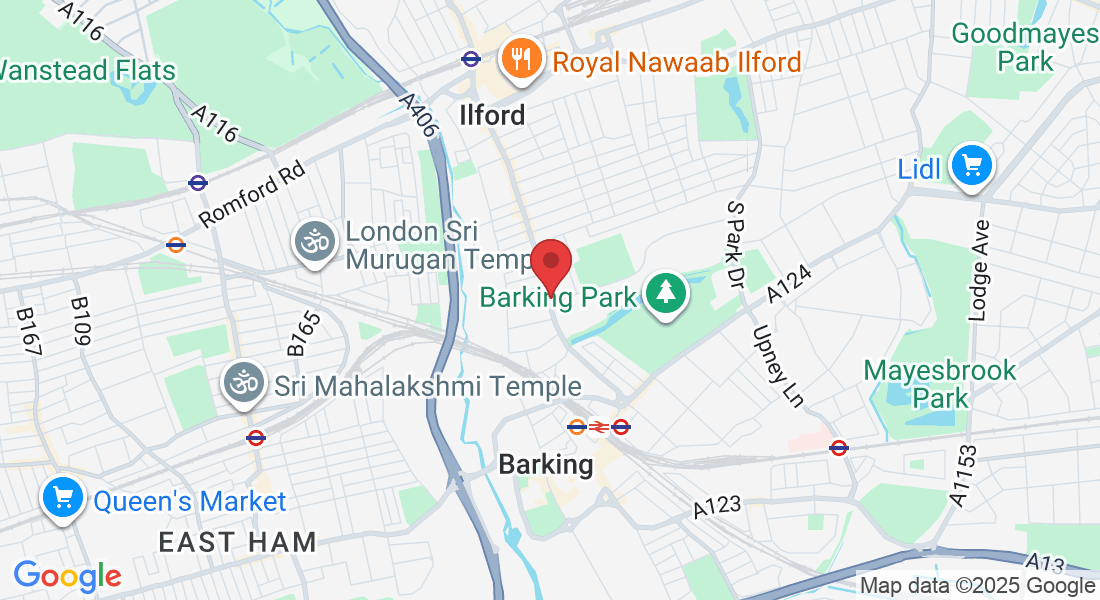

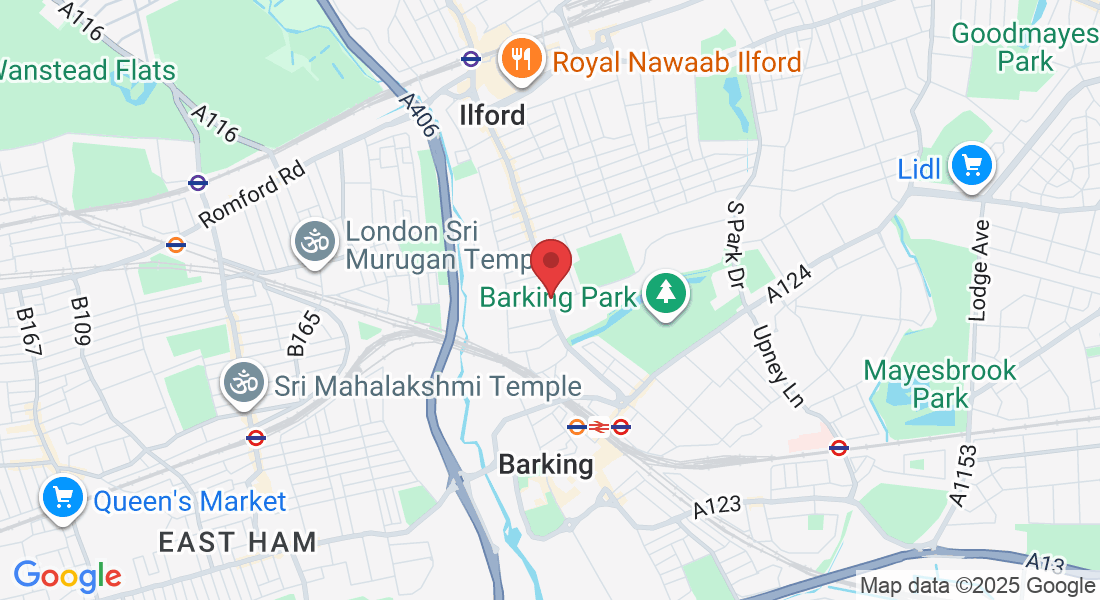

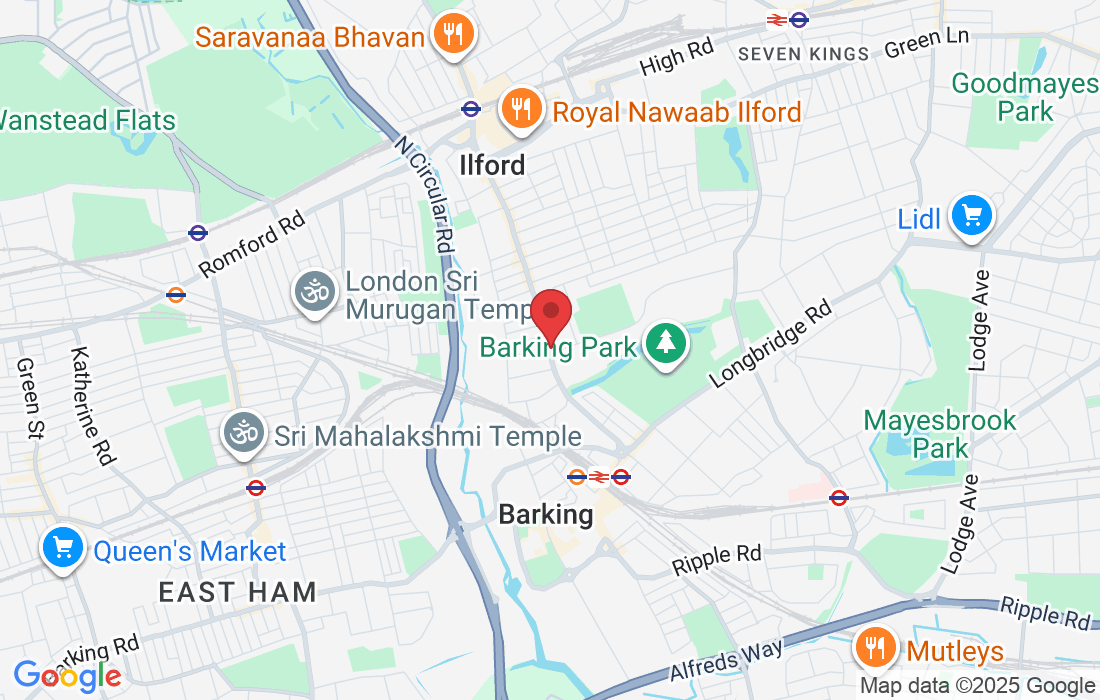

Address: Ilford Lane, Ilford, England, IG1 2SN

Email: [email protected]

Phone: 0741 410 7585

Opening Hours: Available 24/7 to answer your questions and guide you.

You can also complete our online eligibility form anytime, 24/7

Funding Freddie is a trading name of Digital Success Blueprint Ltd. Registered in England and Wales. Registered address: 411 Ilford Lane, Ilford, England, IG1 2SN.

Funding Freddie is not a lender. We act as an introducer, connecting SMEs with a panel of carefully selected FCA-authorised lenders. All loan agreements are made directly between the applicant and the lender.