Invoice Factoring vs. Business Loans — Which is Right for You?

Running a small or medium-sized business (SME) often means managing cash flow challenges while still chasing growth. When money is tied up in unpaid invoices or you need capital to cover expenses, two of the most common options are invoice factoring and business loans.

But which is right for your business? In this guide, we’ll break down how invoice factoring works, how it differs from traditional loans, the pros and cons of each, and which solution fits best for SMEs in the UK.

What is Invoice Factoring?

Invoice factoring is a form of financing that allows you to unlock cash tied up in unpaid customer invoices.

Instead of waiting 30, 60, or even 90 days for clients to pay, you sell your outstanding invoices to a factoring company (also known as the “factor”). The factor then gives you an advance — usually between 70–90% of the invoice value — almost immediately. Once the customer pays the invoice, you receive the balance, minus the factor’s fee.

Example:

A digital agency in Manchester has £50,000 in unpaid invoices. Rather than waiting 60 days for payment, they use invoice factoring and receive £45,000 within 24 hours. The factoring company keeps a small fee, and the agency can now pay staff and take on new projects without worrying about cash flow.

Key Benefits of Invoice Factoring:

Apply Improves cash flow quickly.

No need for additional debt.

Approval is based on client creditworthiness, not just yours.

How Does It Differ from Business Loans?

While invoice factoring is tied directly to your receivables, business loans are borrowed sums you agree to repay over time.

Business Loans UK:

Offered by banks, alternative lenders, or fintech providers.

Typically available as term loans, working capital loans, or expansion loans.

You receive a lump sum (e.g., £50,000) and repay in fixed instalments, with interest, over months or years.

Approval depends on your credit history, turnover, and trading record.

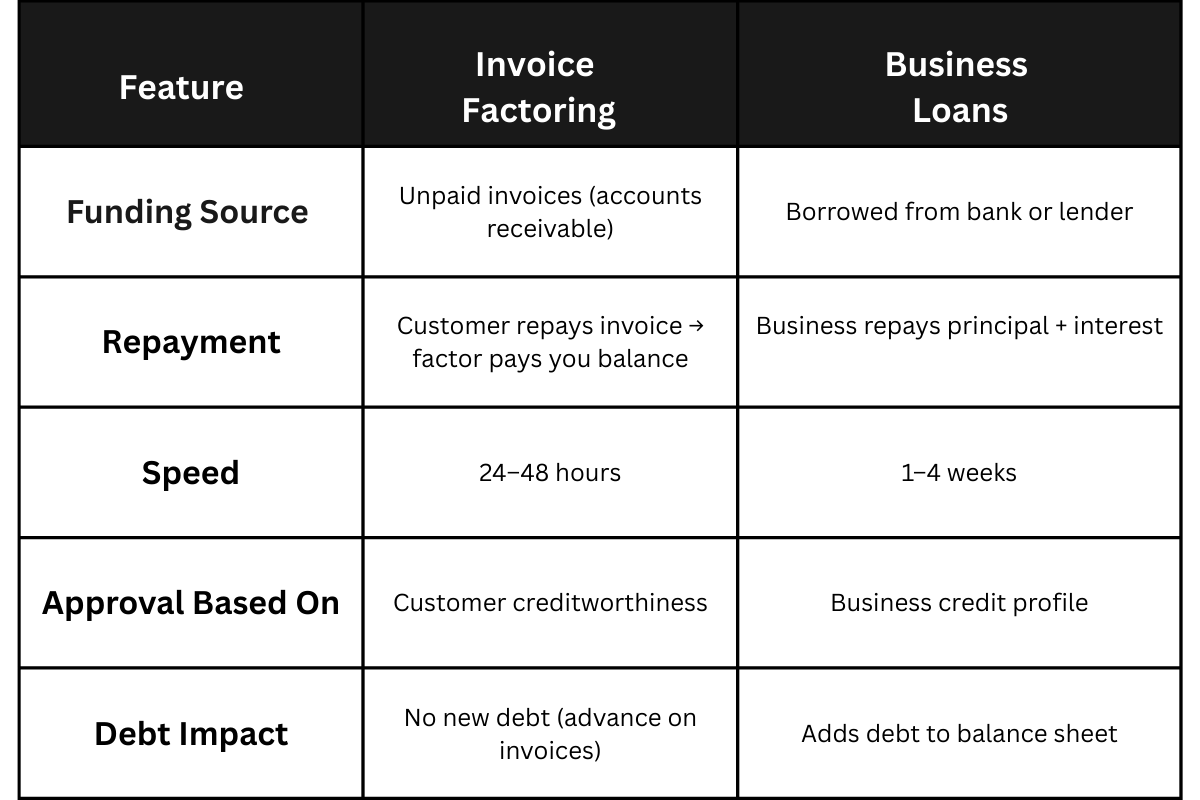

The Key Differences

Pros & Cons of Each

Invoice Factoring

Pros

Quick access to cash.

Improves working capital without debt.

Useful for businesses with long invoice cycles.

Scalable — grows with your invoicing

Cons

Factor fees can be higher than loan interest.

Customers know you’re using a factor (may affect relationships).

Not ideal if you don’t have large or regular invoices.

Business Loans

Pros

Larger sums available (e.g., £50k–£500k).

Flexible use — expansion, equipment, property, marketing.

Lower interest than factoring if you qualify.

Builds credit history for future borrowing.

Cons

Requires good business credit and trading history.

Slower approval process.

Adds debt to your balance sheet.

Regular repayments, even if your sales dip.

Which Works Best for SMEs?

The right choice depends on your business model and financial situation.

Choose Invoice Factoring if:

You often wait 30–90 days for invoices to be paid.

You have reliable customers with strong credit histories.

You need cash quickly to cover payroll, suppliers, or projects.

Choose Business Loans if:

You need a large lump sum for expansion or investment.

You want predictable repayments over time.

Your business has steady revenue and good credit.

Freddie’s Advice

At Funding Freddie, we often see SMEs use both solutions at different times.

Use invoice factoring for short-term cash flow challenges.

Use business loans for long-term growth projects.

The good news? You don’t have to decide alone. Freddie’s eligibility quiz matches your business with FCA-authorised lenders who offer both options, so you can compare side by side.

Click The Button Below To...

Address: Ilford Lane, Ilford, England, IG1 2SN

Email: [email protected]

Phone: 0741 410 7585

Opening Hours: Available 24/7 to answer your questions and guide you.

You can also complete our online eligibility form anytime, 24/7

Funding Freddie is a trading name of Digital Success Blueprint Ltd. Registered in England and Wales. Registered address: 411 Ilford Lane, Ilford, England, IG1 2SN.

Funding Freddie is not a lender. We act as an introducer, connecting SMEs with a panel of carefully selected FCA-authorised lenders. All loan agreements are made directly between the applicant and the lender.