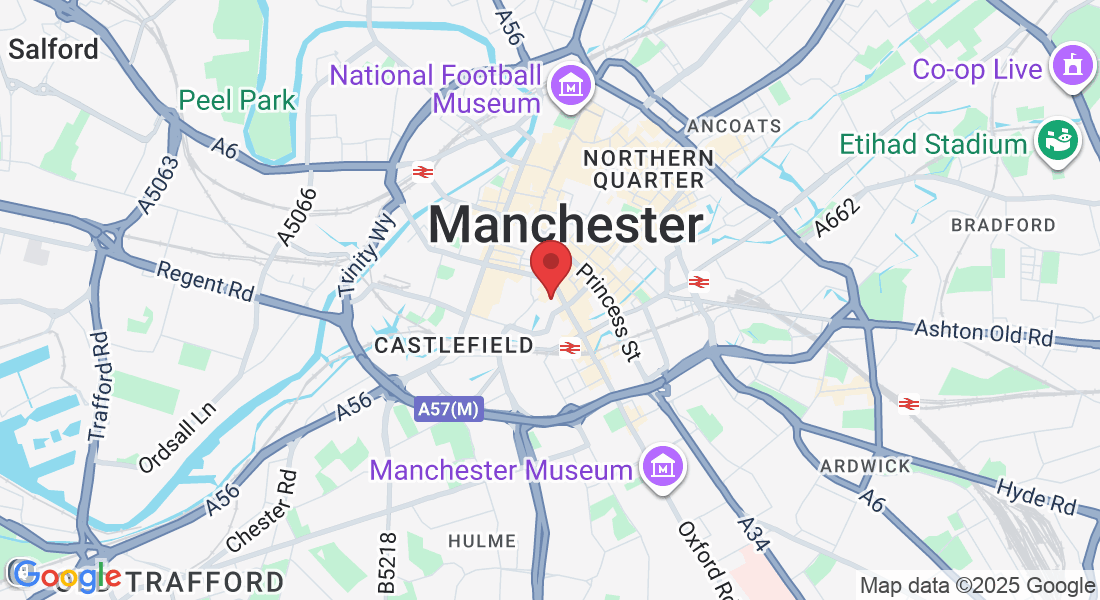

Trusted Commercial Finance Broker in Manchester

Commercial Finance Broker in Manchester — Fast, Flexible SME Funding

Running a business in Manchester’s fast-growing economy comes with opportunity and pressure in equal measure. From rising costs and delayed invoices to the need for new staff or equipment, every decision affects cash flow.

At Funding Freddie, we make funding simple for Greater Manchester’s SMEs. One application connects you to multiple FCA-authorised lenders offering £50k–£500k in tailored finance — so you can keep growing without the red tape.

The Smarter Way to Secure Business Funding

Why Work With a Commercial Finance Broker In Manchester?

Manchester is home to more than 124,000 SMEs, contributing billions to the regional economy. Yet 64 percent of small firms say accessing funding through banks is too slow or restrictive (British Business Bank, 2024).

Funding Freddie removes those barriers:

One simple form → multiple lender offers

Approvals in as little as 24 hours

Flexible loan values £50k–£500k

All lenders FCA-authorised and fully vetted

Whether you trade from Trafford Park, Spinningfields, or Salford Quays, our mission is to make sure finance never limits your business.

Helping London SMEs Access the Right Finance, Fast

Funding Freddie — Your Local Partner for SME Finance

At Funding Freddie, we specialise in helping London SMEs unlock growth through the right type of finance.

Our process is simple:

One simple form → takes under 60 seconds.

Smart matching → Freddie connects you with multiple FCA-approved lenders.

Your choice → review offers, compare rates, and choose the one that works best.

No obligation.

No pressure.

No hidden fees.

Just clear, flexible funding — the way it should be.

Types of Business Funding Available in Manchester

Every SME has unique goals, so we match each business to the right funding product.

Working Capital Loans Manchester

Cover everyday costs — payroll, suppliers, rent — without touching your reserves. Perfect for smoothing seasonal dips or growth spikes.

👉Explore Working Capital Loans

Expansion Loans Manchester

Finance major growth projects: opening new branches, hiring teams, or launching services.

👉Explore Expansion Loans

Equipment Financing Manchester

Spread the cost of machinery, IT systems, or commercial vehicles over fixed monthly terms.

👉Explore Equipment Financing

Invoice Factoring Manchester

Turn unpaid invoices into instant working capital and protect cash flow.

👉 Explore Invoice Factoring →

Commercial Property Loans Manchester

Purchase or refinance premises anywhere in Greater Manchester with flexible, long-term funding.

👉 Explore Commercial Property Loans →

Real Business Success Stories from Manchester SMEs

From Trafford Park to Spinningfields — how Manchester SMEs are thriving with smarter funding.

Case Study 1 — Spinningfields Retailer (£75k Working Capital Loan)

A boutique clothing store in Spinningfields needed capital ahead of Christmas. Freddie matched them with a lender offering £75k in 48 hours. Stock levels rose 40 percent and December sales hit record highs.

Case Study 2 — Trafford Logistics Firm (£250k Expansion Loan)

A logistics company serving Greater Manchester won a large distribution contract but needed more vehicles and staff. We arranged a £250k expansion loan, doubling fleet size and creating 10 new jobs.

Case Study 3 — MediaCityUK Digital Agency (£100k Invoice Factoring)

A creative agency faced 90-day payment cycles. By factoring £100k of receivables, they accessed cash immediately, hired freelancers, and delivered two new campaigns ahead of schedule.

Case Study 4 — Bolton Manufacturer (£400k Equipment Finance)

A precision-engineering firm financed £400k in new CNC machines, boosting output by 60 percent and entering new export markets.

Case Study 5 — Stockport Hospitality Group (£150k Property Loan)

A restaurant group purchased a second site using a £150k commercial property loan, increasing annual turnover by 35 percent.

Inside Manchester’s Rapidly Evolving SME Economy

Market Snapshot — Funding Landscape in Manchester

Manchester has one of the UK’s strongest SME ecosystems, spanning technology, logistics, retail, and hospitality.

99.5 percent of local enterprises are SMEs.

The region attracts over £650 million annually in private investment.

Demand for business lending grew 28 percent year-on-year (Greater Manchester Growth Hub, 2024).

Despite this, only 36 percent of SMEs are approved for full bank loan requests. Brokers like Funding Freddie close that gap by giving access to lenders who understand regional business models and cash-flow realities.

Freddie’s role is to give SMEs confidence — because when small businesses grow, communities thrive. That’s why we’re trusted for secure business finance across the UK.

How It Works

How Funding Freddie Works

Apply Online — Submit your details in under 60 seconds.

Get Matched — Freddie pairs you with FCA-authorised lenders based on turnover, trading length, and funding need.

Compare Offers — Review multiple loan options transparently.

Get Funded — Many approvals within 24 hours; cash in your account within days.

Broker vs Bank vs Online Lenders

Discover which option offers faster approvals, better rates, and transparent service for your business.

Our Lender Network

Connecting Manchester SMEs to the Right Lenders for Every Goal

Funding Freddie works only with FCA-authorised and UK-based lenders that meet strict transparency and data-security standards. Our panel includes specialists in:

Working capital and cash-flow finance

Asset and equipment lending

Invoice and trade finance

Property and commercial mortgages

Each partner undergoes periodic compliance review so every offer presented is fair, competitive, and fully regulated.

Our Lender Network

Who Manchester Expansion Funding Is Right For

You should consider Funding Freddie if your business:

Needs £50k – £500k for growth or stability

Has traded for at least 12 months

Operates within Greater Manchester or North-West England

Wants flexible repayment terms aligned with cash flow

We regularly support companies in Altrincham, Rochdale, Bury, Oldham, and Stockport.

Why Manchester SMEs Choose Freddie Over Banks

Manchester SMEs are choosing simplicity, speed, and transparency — not bank red tape.

Banks

Slow decisions & complex paperwork

Rigid eligibility rules

One-size-fits-all loans

Hidden fees

Single lender

Freddie

Quick digital process

Tailored SME lending

Custom-matched options

Transparent pricing

Multiple FCA-approved lenders

SME loans designed for UK businesses

We make business funding simple, clear, and fast — so you can stay focused on running your company.

FAQ's

FAQs — Business Loans in Manchester

We know applying for business funding can feel overwhelming. That’s why Freddie makes it simple, clear, and transparent.

What is the minimum loan amount available?

👉 Loans start from £50,000, up to £500,000 or more for qualified businesses.

How long does approval take?

👉 Some clients receive approval within 24 hours and funding within 2–3 days.

What interest rates can I expect?

👉 Rates vary by lender, sector, and credit profile, but typically range between 8 – 14 percent APR for secured and 12 – 18 percent APR for unsecured loans.

Can limited companies and partnerships apply?

👉 Yes. We work with limited companies, LLPs, and sole traders across Greater Manchester.

Can I refinance an existing loan?

👉 Many lenders offer refinancing options to lower repayments or consolidate debts.

Do I need collateral?

👉 Some lenders require security for larger loans; smaller amounts can be unsecured.

What documents are required?

👉 Basic financial statements, 3–6 months of bank statements, and proof of trading address.

What if my business was declined by a bank?

👉 That’s exactly why Freddie exists — alternative lenders often approve healthy SMEs that banks overlook.

Join hundreds of UK businesses already securing funding through trusted FCA-authorised lenders.

Backed by Trusted Manchester Networks

Local Business Resources & Partners

Funding Freddie proudly supports local business communities through partnerships and resources:

Greater Manchester Chamber of Commerce — networking and export support

Growth Company Business Finance — regional finance programmes

British Business Bank — national SME funding insights

Linking to these trusted bodies reinforces transparency and credibility.

Ready to Explore Your Options?

Accessing business funding in Manchester no longer needs to be stressful. With Freddie, you can compare competitive offers from FCA-authorised lenders in minutes and secure the capital your business deserves.

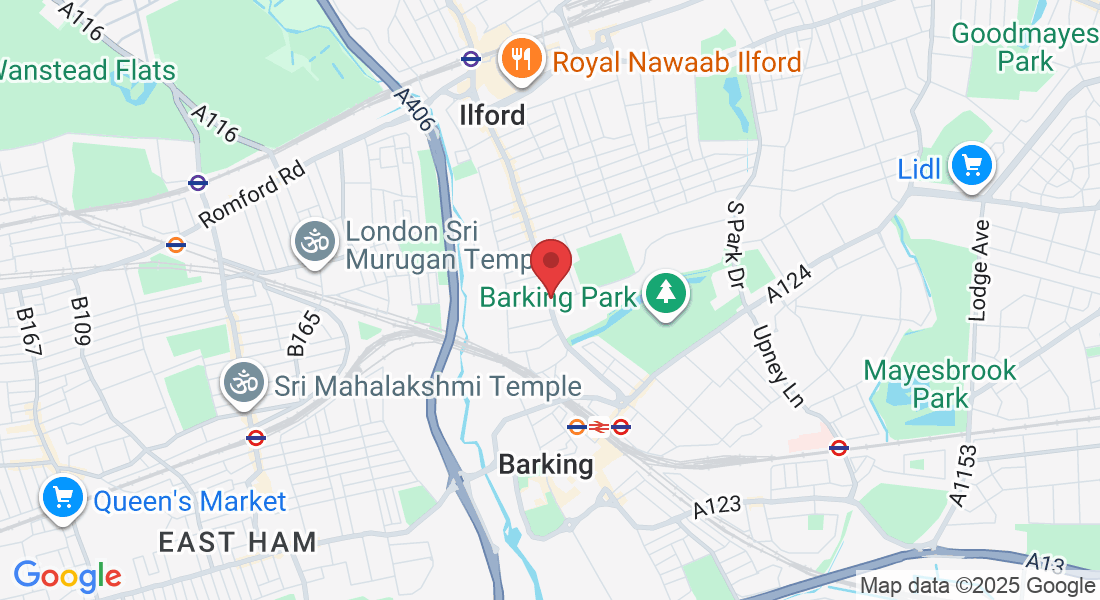

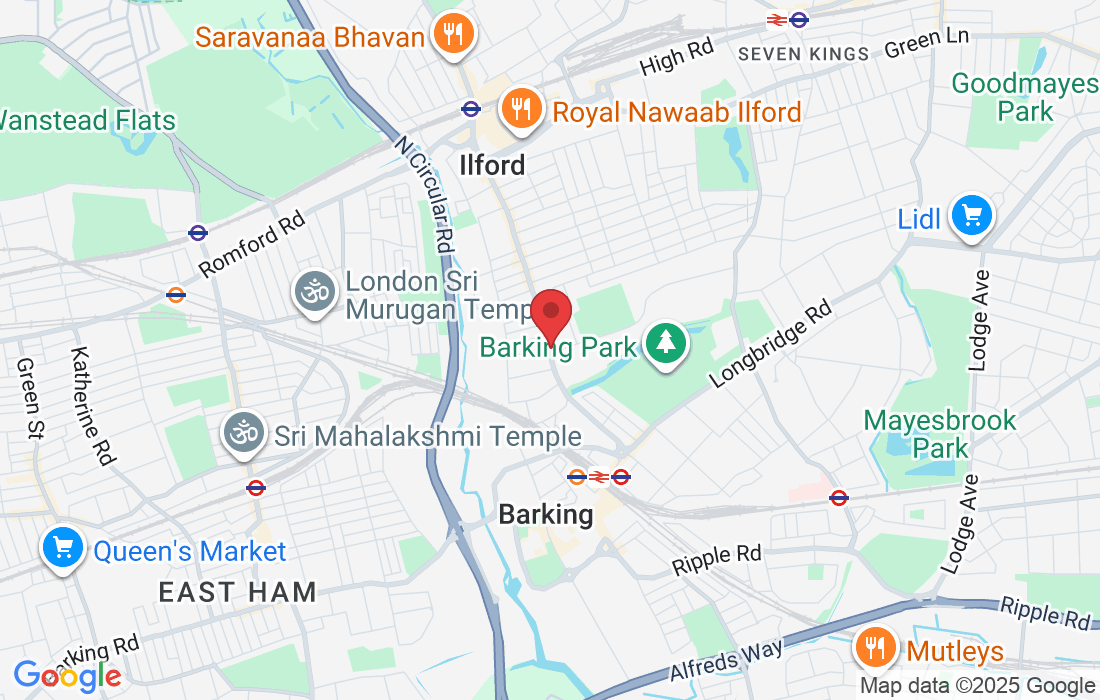

Address: Ilford Lane, Ilford, England, IG1 2SN

Email: [email protected]

Phone: 0741 410 7585

Opening Hours: Available 24/7 to answer your questions and guide you.

You can also complete our online eligibility form anytime, 24/7

Funding Freddie is a trading name of Digital Success Blueprint Ltd. Registered in England and Wales. Registered address: 411 Ilford Lane, Ilford, England, IG1 2SN.

Funding Freddie is not a lender. We act as an introducer, connecting SMEs with a panel of carefully selected FCA-authorised lenders. All loan agreements are made directly between the applicant and the lender.